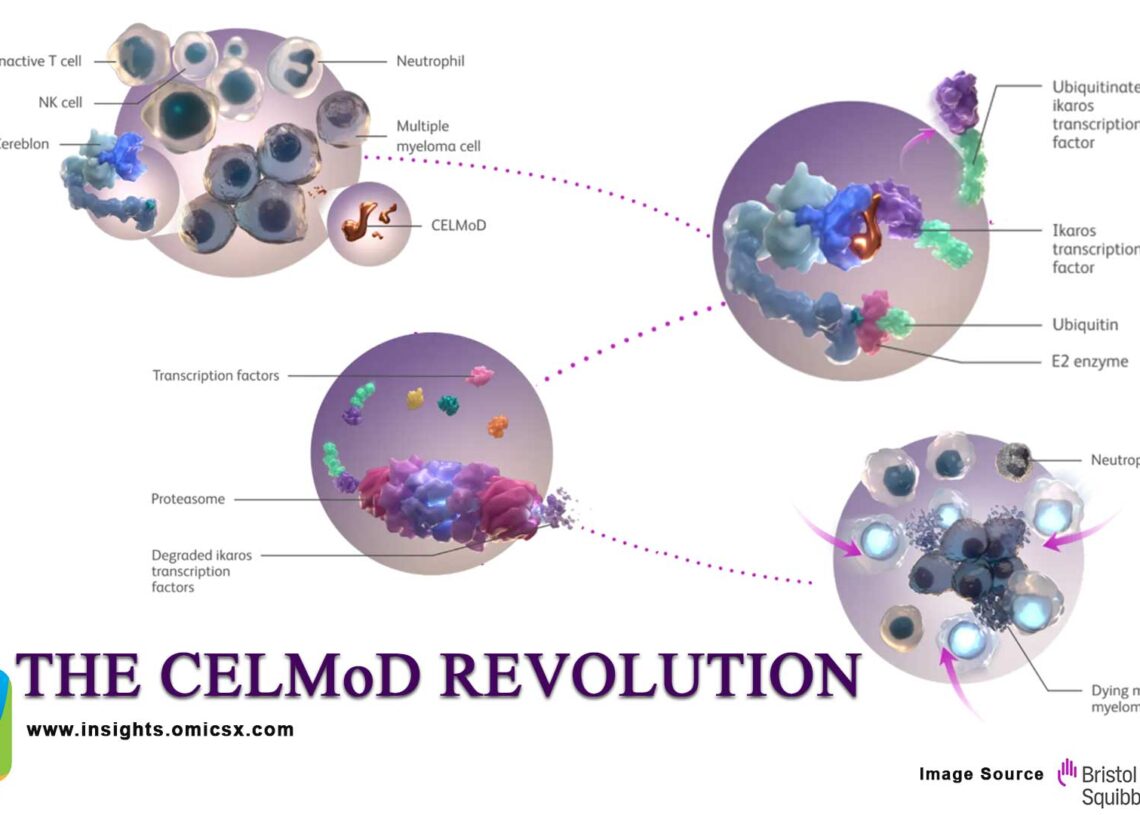

Bristol-Myers Squibb stands at the precipice of revolutionizing multiple myeloma treatment with two next-generation Cereblon E3 Ligase Modulators (CELMoDs) that could fundamentally reshape the competitive landscape. As the only pharmaceutical company with three approved targeted protein degradation drugs already on the market, BMS is leveraging its unparalleled TPD expertise to advance two complementary CELMoD agents that promise to address the limitations of current immunomodulatory therapies. Both Iberdomide (CC-220) and Mezigdomide (CC-92480) were originally discovered and developed by Celgene Corporation, prior to its acquisition by Bristol Myers Squibb (BMS) in 2019.

1. Iberdomide: The Phase III Pioneer Leading the Next Generation

Drug Overview

Building on Celgene’s proven IMiD platform, Iberdomide (CC-220) represents the most advanced next-generation CELMoD agent currently in clinical development. This novel compound demonstrates >20-fold higher cereblon binding affinity compared to the acquired lenalidomide and pomalidomide, enabling more potent and selective protein degradation of the transcription factors Aiolos and Ikaros.

The drug leverages Bristol-Myers’ inherited expertise from the Celgene acquisition, utilizing the same fundamental mechanism that generated billions in revenue while addressing the resistance patterns observed with first-generation IMiDs.

Clinical Success Prospects

Based on exceptional Phase I/II clinical data, iberdomide has an estimated 80-90% likelihood of regulatory approval, positioning it to potentially replace declining Revlimid revenues with next-generation efficacy.

Key Success Indicators:

-

94.7% overall response rate in transplant-ineligible newly diagnosed multiple myeloma patients

-

57.3% complete response rate – significantly higher than Celgene’s original IMiDs

-

43.1% MRD negativity in patients with very good partial response or better

-

FDA Fast Track designation validating the evolution from Celgene’s platform

Current Phase III Program:

-

EXCALIBER-RRMM trial: Comparing iberdomide + daratumumab + dexamethasone versus standard-of-care

-

Post-transplant maintenance trial: Potential to replace lenalidomide as standard maintenance therapy

-

Expected regulatory submission: Late 2025-2026, leveraging Celgene’s regulatory pathway experience

Market Size and Revenue Replacement Strategy

With Revlimid facing patent cliff pressures (starting 2026), iberdomide represents Bristol-Myers’ strategy to maintain the $10+ billion annual revenue stream established through the Celgene acquisition.

Peak Sales Projections:

-

Conservative estimate: $3-4 billion annually, replacing portion of declining Revlimid sales.

-

Optimistic scenario: $5-6 billion with expanded indications and combination therapies.

-

Revenue timing: 2026-2027 launch coincides with Revlimid generic competition.

2. Mezigdomide: The Ultra-Potent Evolution

Drug Overview

Mezigdomide (CC-92480) represents the pinnacle of Bristol-Myers’ post-Celgene innovation, featuring even greater cereblon-binding potency than iberdomide. This ultra-potent degrader addresses the next evolution beyond Celgene’s original portfolio, targeting patients with resistance to both legacy IMiDs and first-generation CELMoDs.

Pre-clinical studies demonstrate Mezigdomide is “much more potent than Iberdomide, which in turn is 20 to 40 times more potent” than the acquired Celgene agents, representing a three-generation evolution in TPD technology.

Clinical Success Prospects

Mezigdomide’s clinical success probability is estimated at 75-85%, building on both the Celgene legacy data and iberdomide’s advancing clinical validation.

Development Advantages:

-

Platform evolution: Each generation builds on Celgene’s foundational clinical experience

-

Resistance management: Designed to overcome limitations of acquired IMiD portfolio

-

Post-CAR-T positioning: Addressing treatment gaps not covered by original Celgene drugs

Market Positioning and Revenue Potential

Mezigdomide’s strategic positioning targets the $2-3 billion post-resistance market, complementing iberdomide’s broader revenue replacement strategy.

Revenue Strategy:

-

Sequential therapy approach: Capturing patients progressing through Celgene legacy drugs → iberdomide → mezigdomide

-

Enhanced potency premium: Superior efficacy commands higher pricing than original Celgene portfolio

-

Extended patent protection: Longer exclusivity period than acquired assets

Strategic Synergy: From Celgene Legacy to Next-Generation Dominance

The combination of Celgene’s proven revenue foundation with next-generation CELMoD innovation creates an unprecedented competitive position in multiple myeloma treatment.

Revenue Transition Strategy

Financial Bridge Approach:

-

Current phase (2024-2026): Celgene legacy drugs generate $8-10 billion annually, funding R&D

-

Transition phase (2026-2028): Iberdomide launch begins revenue replacement as Revlimid declines

-

Dominance phase (2028-2035): Dual-CELMoD portfolio generates $5-8 billion annually

Clinical Evolution Pathway

Treatment Algorithm Integration:

-

First-line therapy: Iberdomide + combinations replace Revlimid-based regimens

-

Resistance management: Mezigdomide addresses failures of both legacy and next-generation agents

-

Platform validation: Success builds on Celgene’s established clinical foundation

Competitive Moat Strengthening

The Celgene acquisition created barriers that competitors cannot easily replicate:

-

20+ years of clinical data in cereblon modulation

-

Regulatory pathway expertise from three approved drugs

-

Manufacturing scale for complex degrader molecules

-

Market access relationships established through legacy drug success

Impact on Current Market Leaders

Bristol-Myers Squibb to maintain and expand its multiple myeloma market leadership through approval of these drugs which may further challenge –

Johnson & Johnson (Darzalex franchise):

-

Combination pressure: Next-generation CELMoDs may replace daratumumab + Revlimid with iberdomide combinations

-

Market share defense: Must adapt to superior CELMoD efficacy benchmarks

-

Revenue at risk: $8+ billion Darzalex franchise faces enhanced competition

Revenue Impact Analysis

Market Transformation Economics:

-

Celgene legacy decline: Revlimid peak $12 billion → $2-3 billion by 2030.

-

Next-generation capture: Iberdomide/mezigdomide $5-8 billion peak sales by 2032.

-

Net portfolio effect: Maintains Bristol-Myers’ $8-12 billion annual multiple myeloma revenue stream.

Conclusion: From Acquisition to Revolution

Bristol-Myers Squibb’s $74 billion Celgene acquisition laid the foundation for what could become the most successful pharmaceutical platform transition in history. By leveraging $15+ billion in annual legacy drug revenues to fund development of iberdomide and mezigdomide, the company has created a strategic bridge from first-generation TPD success to next-generation market dominance.

This comprehensive approach—acquisition of proven assets + development of superior successors—provides a blueprint for pharmaceutical value creation that competitors will struggle to match, ensuring Bristol-Myers Squibb’s continued leadership in the rapidly evolving targeted protein degradation landscape.